Sponsorship Opportunities

Sponsorship Opportunities

Where leaders of financial risk management meet and exchange ideas on how to get ahead in the new era of risk

Risk Europe gathers over 1000 risk management decision makers and influencers allocating risk budgets at world leading financial institutions. No other event gives you the same opportunity to showcase your brand, deliver thought leadership, meet, network, build relationships with and make an impact on potential customers.

Past Risk Europe sponsors include:

With the unique combination of financial services, technology and regulatory expertise, IBM enables institutions to make more timely and risk-aware decisions. IBM applies the latest advancements in artificial intelligence, machine learning and automation to the risk and compliance process, increasing operational efficiency, accelerating insight and improving transparency. This greater oversight and understanding helps IBM's clients preserve institutional trust and enhance value to their shareholders and customers alike.

To learn more about IBM financial crime and regulatory compliance solutions, visit ibm.com/RegTech and follow on Twitter @IBMFintech

Quantitative Risk Management is the world's leading enterprise risk management consulting firm. QRM develops industry-leading risk management principles, practices, and models, and provides clients with the advice, knowledge, and tools necessary to adopt those innovations, thus increasing their risk-adjusted returns. For over 25 years, QRM has partnered with clients to enhance their ability to measure risk, identify profitable opportunities, and make sound financial decisions. With offices in Chicago, London, and Singapore, QRM has established over 250 long-term engagements with top financial institutions from the banking, finance, and insurance industries worldwide.

For nearly four decades, State Street Global Advisors has been committed to helping financial professionals and those who rely on them achieve their investment objectives. We partner with institutions and financial professionals to help them reach their goals through a rigorous, research-driven process spanning both active and index disciplines. We take pride in working closely with our clients to develop precise investment strategies, including our pioneering family of SPDR ETFs. With millions* in assets under management, our scale and global footprint provide access to markets and asset classes, and allow us to deliver expert insights and investment solutions.

State Street Global Advisors is the investment management arm of State Street Corporation.

* Assets under management were $2.51 trillion as of December 31, 2018. AUM reflects approx. $32.45 billion (as of December 31, 2018) with respect to which State Street Global Advisors Funds Distributors, LLC (SSGA FD) serves as marketing agent; SSGA FD and State Street Global Advisors are affiliated.

Protiviti is a global consulting firm that helps companies solve problems in finance, technology, operation, governance, risk and internal audit, and has served more than 60 percent of Fortune 1000® and 35 percent of Fortune Global 500® companies. Our Model Risk Management practice provides experienced quantitative analysts to develop and validate a variety of models, and our holistic process helps control risk, prevent losses and enhances key stakeholders’ understanding of model risk. We can develop customized quantitative models, refine and calibrate existing models, and design stress testing and scenario analysis programs to supplement existing analytics. Areas of expertise include: Model Risk Governance Assessment, Model Development, Model Validation, Model Audit Support, Stress Testing, IFRS9/CECL, Initial Margin Model, and Market Risk/FRTB.

At EY, we share a single focus — to build a better financial services industry, one that is stronger, fairer and more sustainable.

Our strength lies in the proven power of our people and technology, and the possibilities that arise when they converge to reframe the future.

Our professionals are dedicated to the industry, and live and breathe financial services. This deep sector knowledge combined with a holistic point of view, delivers true value from strategy through to implementation. Whether your business challenge is specific, complex, small or large, we can be trusted to deliver solutions that work for today and tomorrow.

By using technology as a tool, to transform what a business can be, and people can do, we are building long-term value for our financial services clients. It is how we play our part in building a better working world.

Deloitte Risk and Financial Advisory helps organisations turn critical and complex business issues into opportunities for growth, resilience and long-term advantage. Deloitte's market-leading teams help its clients manage strategic, financial, operational, technological and regulatory risk to enhance enterprise value, while experience in mergers and acquisitions, fraud, litigation and reorganisation helps clients emerge stronger and more resilient.

For 12 years, Amazon Web Services has been among the world's most comprehensive and broadly adopted cloud platforms. AWS offers over 100 fully featured services for compute, storage, networking, database, analytics, application services, deployment, management, developer, mobile, the Internet of Things (IoT), artificial intelligence (AI), security, hybrid, and enterprise applications, from 55 Availability Zones (AZs) across 18 geographic regions in the United States, Australia, Brazil, Canada, China, Germany, India, Ireland, Japan, Korea, Singapore, and the United Kingdom. AWS services are trusted by millions of active customers around the world – including the fastest-growing startups, largest enterprises, and leading government agencies – to power their infrastructure, make them more agile, and lower costs.

NEX Markets is a leading electronic trading platforms and solutions business in foreign exchange and fixed income.

Our market leading suite of EBS products and services include central limit order books, bilateral trading venues, end-to-end workflow and market data solutions that provide the FX trading community with access to diverse, valuable liquidity and market insight – all in one place.

As a customer you will benefit from the group’s scale and centralised network, dedicated customer support and footprint.

NEX Markets is part of the NEX Group, a forward thinking, technology-based services company.

For more information visit nexmarkets.com.

TriOptima is the leading multilateral compression provider that lowers costs and mitigates risk in over-the-counter (OTC) derivatives markets, and is now part of CME Group. As the world's leading and most diverse derivatives marketplace, CME Group (www.cmegroup.com) enables clients to trade futures, options, cash and OTC markets, optimise portfolios and analyse data – empowering market participants worldwide to efficiently manage risk and capture opportunities. CME Group exchanges offer the widest range of global benchmark products across all major asset classes based on interest rates, equity indexes, foreign exchange, energy, agricultural products and metals.

For more than 30 years, Murex has been providing enterprise-wide, cross-asset financial technology solutions to capital markets players. Its cross-function platform, MX.3, supports trading, treasury, risk and post-trade operations, enabling clients to better meet regulatory requirements, manage enterprise-wide risk, and control IT costs. With more than 50,000 daily users in 60 countries, Murex has clients in many sectors, from banking and asset management to energy and commodities.

Murex is an independent company with over 2,000 employees across 17 countries. Murex is committed to providing cutting-edge technology, superior customer service, and unique product innovation.

For more information visit murex.com

FactSet delivers content, analytics and flexible technology to help more than 160,000 users see and seize opportunities as soon as possible. It offers investment professionals informed insights and workflow solutions across the portfolio lifecycle, and industry-leading support from dedicated specialists.

About FINCAD

FINCAD is the leading provider of enterprise portfolio and risk analytics for multi-asset derivatives and fixed income. An industry standard since 1990, our advanced analytics, flexible architecture and patented technology enable better investment and risk management decisions. We are committed to helping our clients solve their toughest challenges, without compromise. Clients include leading global asset managers, hedge funds, insurance companies, pension funds, banks and auditors. For more information, visit www.fincad.com.

MSCI is a leading provider of critical decision-support tools and services for the global investment community. With over 50 years' expertise in research, data and technology, MSCI powers better investment decisions by enabling clients to understand and analyse key drivers of risk and return, and to confidently build more effective portfolios. MSCI creates industry-leading research-enhanced solutions that clients use to gain insight into and improve transparency across the investment process.

AxiomSL, a leading global provider of solutions and managed services, delivers efficient risk and regulatory data-management and reporting outcomes for financial institutions. Clients leverage AxiomSL’s solutions across financial, liquidity, capital and credit, shareholding disclosure, trade and transaction, and tax mandates. Its single, fully managed, audit-empowered offering, RegCloud® – AxiomSL’s ControllerView® platform in the cloud, futureproofs clients against technology and regulatory change. AxiomSL’s client base spans national, regional, and global financial institutions. These comprise banks with $45 trillion in total assets including 80% of G-SIBs; investment managers with $13 trillion in assets under management; and 30% of the top 60 US broker-dealers representing $44 billion in shareholder equity. It covers 110 regulators across 50 jurisdictions. AxiomSL ranks in the top 20 of the Chartis RiskTech100®.

FIS is the world's largest global provider dedicated to financial technology solutions. FIS empowers the financial world with software, services, consulting and outsourcing solutions focused on retail and institutional banking, payments, asset and wealth management, risk and compliance, trade enablement, transaction processing and record-keeping. FIS’ more than 53,000 worldwide employees are passionate about moving their clients’ businesses forward.

Broadridge Financial Solutions, Inc. (NYSE:BR) a global fintech leader with more than US$4 billion in annual revenue, provides investor communications and technology-driven solutions for broker-dealers, banks, mutual funds and corporate issuers globally. Broadridge’s investor communications, securities processing and managed services solutions help clients reduce their capital investments in operations infrastructure, allowing them to increase their focus on core business activities. With over 50 years of experience, Broadridge’s infrastructure underpins proxy voting services for over 50 percent of public companies and mutual funds globally, and processes more than US$5 trillion in fixed income and equity trades per day. Broadridge employs approximately 10,000 full-time associates in 16 countries.

For more information about Broadridge, please visit www.broadridge.com.

ブロードリッジ(NYSE:BR)は、総収入40億ドルを超えるグローバル・フィンテック・リーダーです。ブロードリッジは世界中のブローカー・ディーラーをはじめ、銀行、投資信託、企業発行体に対し、投資家コミュニケーションやテクノロジーに基づくソリューションを提供しています。ブロードリッジが提供する投資家コミュニケーション、証券処理および管理サービスソリューションにより、お客様はオペレーションインフラへの資本投資を削減し、本来の事業活動により注力できるようになります。ブロードリッジのインフラストラクチャーは、50年以上にわたる実績とともに、世界中の50%以上の上場企業および投資信託に対する議決権行使を支えており、一日に5兆ドル以上の債券および株式取引を処理しています。ブロードリッジは、世界16カ国におよそ10,000人の正社員を擁しています。

ブロードリッジに関する詳細は、ウェブサイト(www.broadridge.com/jp)よりご確認いただけます。

Numerix is the leading provider of innovative capital markets technology applications and real-time intelligence capabilities for trading and risk management. It drives an open fintech-oriented digital financial services market. Numerix is uniquely positioned in the financial services ecosystem to help its users reimagine operations, modernise business processes and capture profitability.

Founded by a group of industry experts, ActiveViam understands the data analytics challenges faced by financial institutions across trading desks, risk, and compliance. That is why we pioneered the use of high-performance analytics in finance, helping the largest investment banks, asset managers and hedge funds make better decisions, explain results with confidence, and simulate the impact of their decisions.

Our mission is to deliver train-of-thought analysis on terabytes of data in the most cost-effective way so our customers can explain their results with confidence and model the scenarios that will optimize their business. We are a pure player specializing in risk data analytics for one of the fastest moving and most regulated industries with a presence in the world’s leading financial marketplaces: London, New York, Singapore, Sydney, Hong Kong, Paris and Frankfurt.

For more information please visit: www.activeviam.com

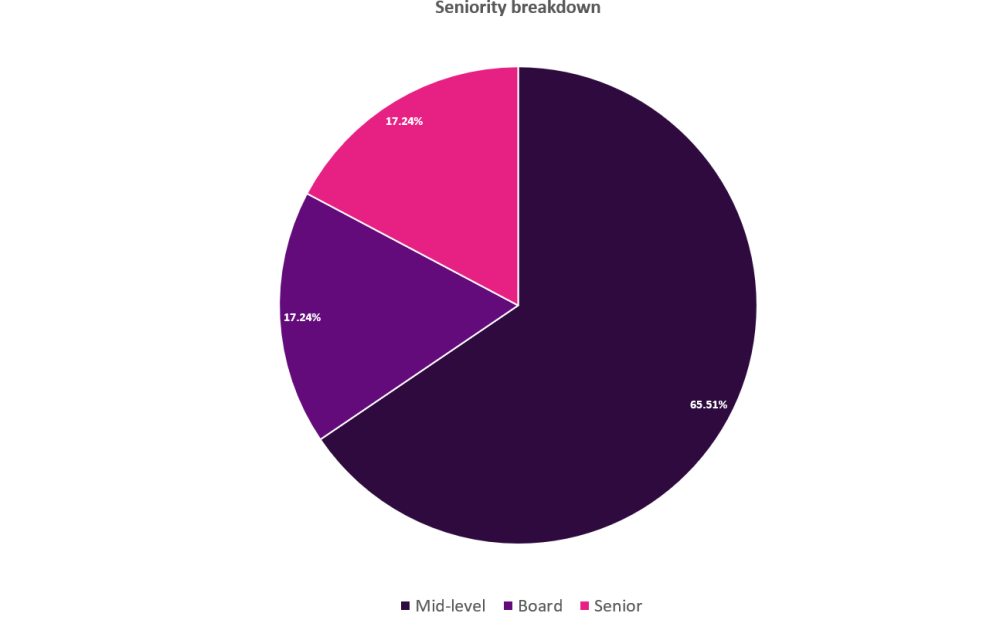

Audience breakdown - Seniority

- Spark partnerships by meeting senior global professionals from the buy-side, banks, regulators, academics, and more

- Over 61% of Risk USA attendees are senior and above, position your firm in front of this audience as a thought leader

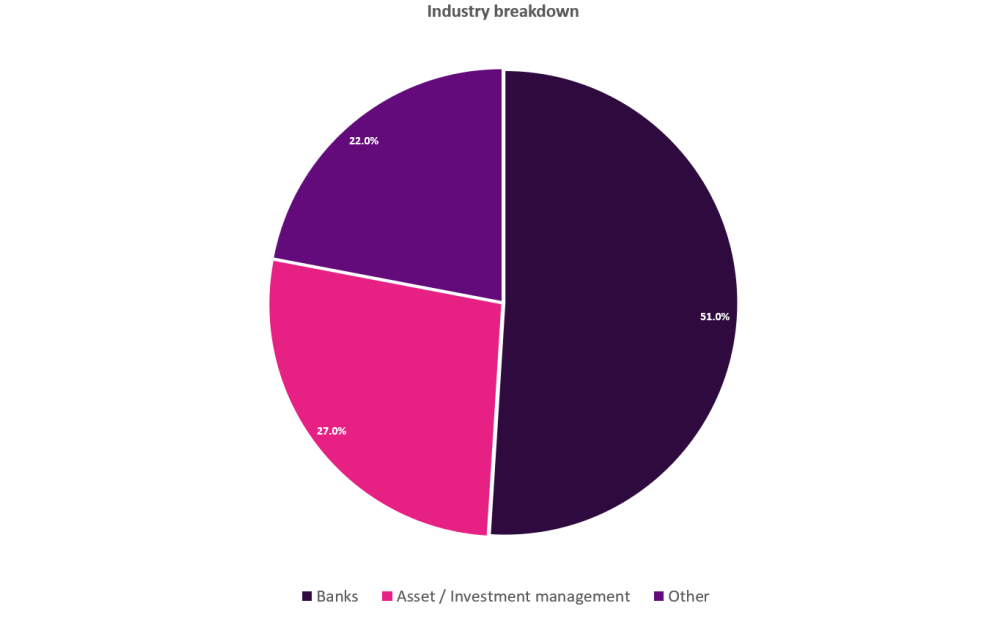

Audience breakdown - Industry

- 500+ delegates registered to join Risk USA last year from 19 countries

- 63% of the audience was classified as buy-side

"Risk Europe brought in very senior decision makers and influencers on the same platform which made the entire event very effective."

Quantel AI

"Extremely knowledgeable speakers, engaging and fielded any questions."

State Street

"Very intimate, well coordinated conference with extremely detailed information that was presented in a very clear and concise manner. Looking forward to participating in future events."

Aston Capital Management